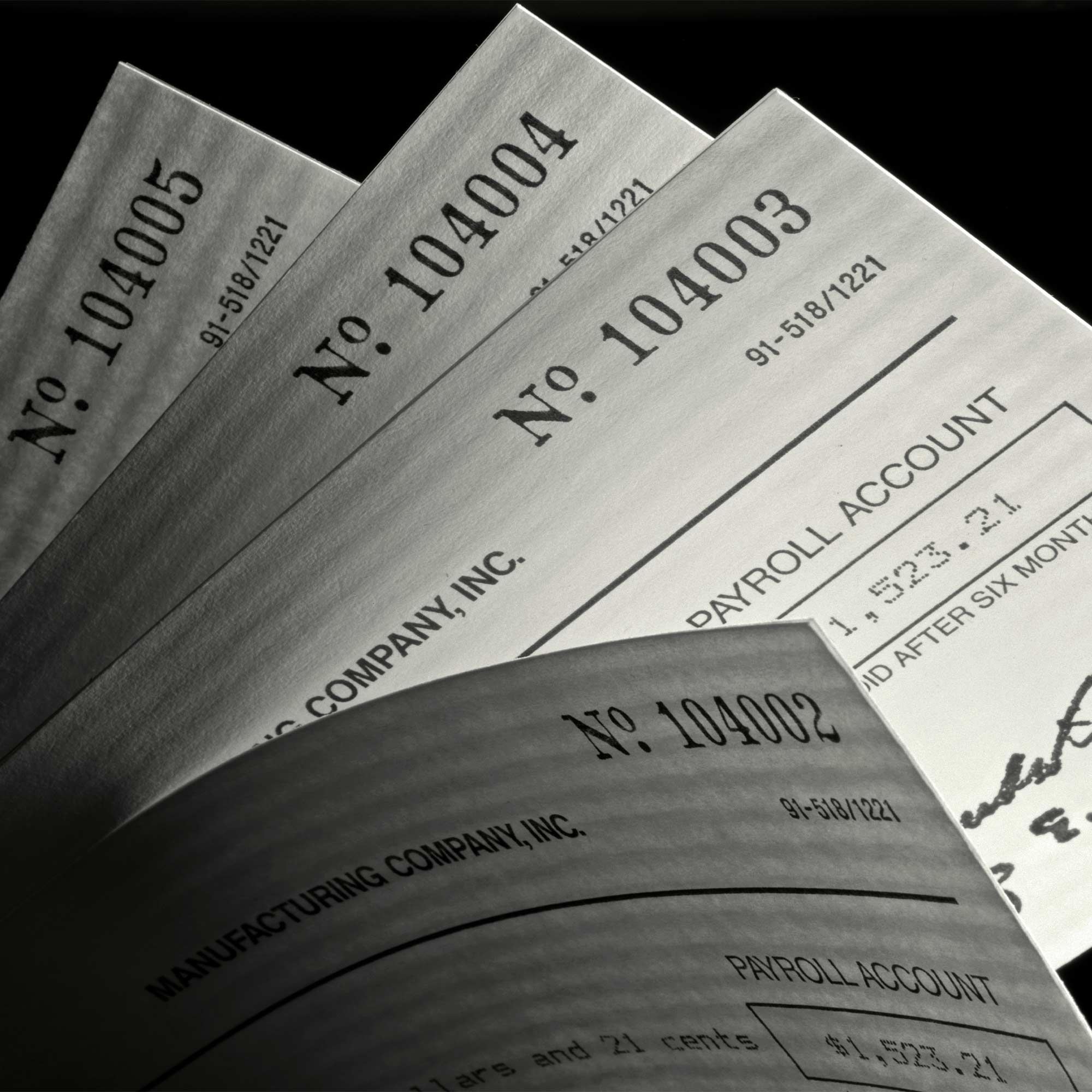

Check Fraud

Check Fraud entails the use of paper or digital checks to gain money illegally.

Examples:

- Altering a legitimate check by changing the payee’s name or dollar amount

- Forgery of an account holder’s signature on a stolen check

- Writing a counterfeit check on an authorized or non-existent account

Businesses and individuals can adopt processes and procedures to decrease occurrences of check-related fraud.

- Enroll in positive pay or reverse positive pay solutions offered by MidFirst Bank

- Reconcile accounts regularly

- Train employees to recognize fraudulent behavior

- Hire trustworthy employees

- Use checks securely — store in secure location, use checks that include security paper and watermarks

Checks are among the most vulnerable payment channels for fraud due to the factors listed above, coupled with sensitive data included on each check. MidFirst Bank offers payment solutions, including ACH, Commercial Cards and Wire Transfers as more secure alternatives to checks.

Contact MidFirst Bank at 888.MIDFIRST (888.643.3477) for more information or to report suspicious activity related to your MidFirst Bank account.